Winpak Ltd

A boring business + Owner's orientation + Focus on innovation & costs = Fantastic Business

BUSINESS

Winpak is a packaging product company based in Canada with majority of revenues (≈80%) from the US. The company is a part of the Wipak Group which has leading positions in the European packaging products market and is controlled by the Wihuri Group, a Finnish group. Mr. Antti Ilmari Aarnio-Wilhuri controls 52.7% of the shares.

Winpak’ products cater to perishable goods and medical devices with its objective being to improve shelf life of the customer’s products and reduce the environmental impact caused by spoilage.

The company’s business can be segmented in three categories: Flexible packaging, Rigid packaging & flexible lidding, and Packaging machinery. The charts below show the company’s revenue mix (2022) across its product lines and geographic markets.

Flexible packaging. Winpak’s focus is on modified atmosphere packaging (MAP) market. MAP is a process where atmosphere is removed either entirely referred to as vacuum packaging or is altered referred to as controlled atmosphere packaging or gas flushed packaging. In the North American markets, MAP has been growing at a faster pace than the broader packaging market driven by the consumer’s demand for increased access to fresh products. MAP also helps food distributors reduce their costs by reducing spoilage as shelf life of the produce is extended.

Company’s flexible packaging products also include paper/poly/foil laminated rollstock and specialty films. The images below as sourced from the company’s website show some of their products.

Rigid packaging and flexible lidding. Rigid packaging caters to single-serve and portion-controlled plastic packaging for food, pet food, beverage, dairy, and healthcare applications. As a leading producer, it offers a full line of plastic cups, trays, and plastic sheet materials.

Winpak is an industry leader in production of heat sealable lidding products and has the leading position in die-cut foil lids in the North American market. Die-cut lidding is pre-cut to the size of the container such that no cut is required by the packaging machine.

Packaging machinery. Specializes in production of custom packaging machinery with speeds greater than 1,600 packages per minute. More than 950 machines in operation worldwide.

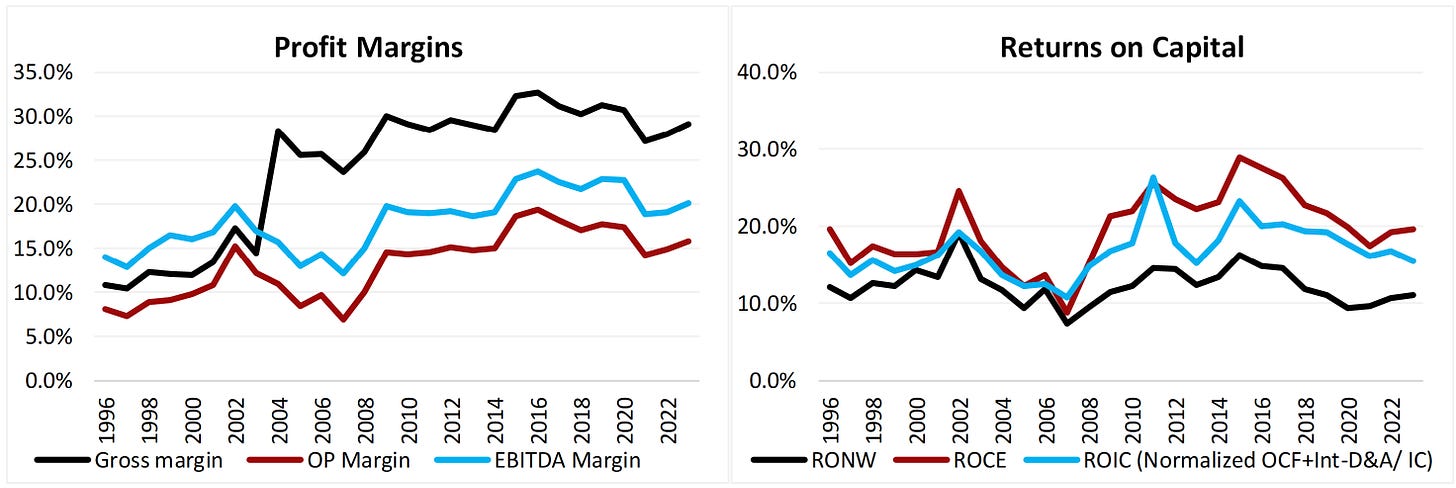

Business Model and Other Important Points. As the description above should make it clear, the company is a producer of undifferentiated products. Further, the products aren’t really complex enough for the buyer’s shopping abilities to be constrained. Accordingly, the most important source of their competitive advantage is cost, i.e., being the low-cost producer. As is seen in the charts below, the company has a very healthy and stable profitability profile with EBIT margins averaging at around 16%. Strong returns on capital with average RoCE of 20%+. While RoE is affected by the substantial cash holdings, it still has averaged at about 12%. These metrics speak to their positioning as a low cost producer, something that the company also lays claim to.

Importantly, about 75% of its revenues are indexed to raw materials pricing providing an inbuilt inflation protection. However, there is usually a 4 month lag to the repricing. Again, this is seen in their profitability which did not suffer during high RM inflation observed in 2021 & 2022. One driver of some profit margin variability is the USD/CAD exchange rate >> 65% of the company’s production capacity is based in Canada while 80% of its revenues are derived from the US.

Customer mix and business growth. Winpak derives about 90% of its revenues from the food & healthcare markets – given the nature of these markets, Winpak’s revenues tend to relatively stable. Its top-15 customers accounted for about 30% of revenues which suggests a well diversified revenue base. Some concentration to the largest customer which accounted for about 9.5% of revenues.

The chart below shows Winpak’s sources of growth over the past 15 years. Over this period, Winpak’s organic growth at constant fx yielded a compounded growth of 5.8% with Volumes being the largest contributor at 4.1%. Pricing contributed positively at 1.7%. M&A was a really small contributor at 0.2% and fx had -0.1% impact on total revenue growth. Note that this analysis is in USD terms.

Corporate Governance and Capital Allocation

Early history. The company was founded in 1978 and IPOed in 1986. In this time period, it operated a single facility in Winnipeg catering to the North American MAP market. From 1988 to 1997, Winpak acquired five companies at a total cost of C$122 mln (≈US$ 95 mln[1]). In the process, its manufacturing base expanded to nine facilities and revenues increased from US$36 mln[2] in 1987 to US$217 mln in 1997. While I do not have the contribution of the Winnipeg facility in the 1997 revenues, if we assume that the 1987 revenues of the existing business grew at a CAGR of 6%, the revenues from the pre-existing business by 1997 would be US$ 60 mln. With OPM of about 8%, the acquired businesses were likely contributing about $13 mln in OP making that $95 mln price tag rather reasonable.

Since 1998. Having built its presence across its product lines, the company has since been focused almost entirely on organic growth. From 1998 to 2023, generated $2.2B in operating cash flows. Spent about half of it on Capex which totaled to $1.1B, almost no M&A with total M&A spend of $90 mln (4% of the OCF generated), and $425 mln in dividends (about 20% of the OCF generated). Paid three special dividends – 2014 C$ 1 per share, 2015 C$ 1.5 per share, and 2021 C$3 per share. No share issuances or buybacks.

Dividend and buybacks. At current level of operations, dividend payout is paltry amounting to just about 5% of profits and free cash flow. The result is that the balance sheet has built up significant excess cash >> as of December 31, 2023, had net cash of US$ 412 mln amounting to about 25% of the current market cap.

On February 29, 2024, the company announced a buyback of 1.95 mln shares amounting to 3% of the shares outstanding and about 6% of its float >> The company stated that there are times when its shares may not fully reflect its underlying value and future prospects and at such times, it will make sense for it buyback its shares. For the buyback program, the company has received a normal course issuer bid (NCIB) from the TSX and has entered into an automatic share purchase plan with CIBC World Markets Inc. Given the average trading volumes over the past six months, its daily purchases will be limited to about 12,000 shares (25% of the volumes) – this will serve to put a bid under the shares for the next 150+ trading days.

Leverage, Pension, and Executive Pay

The company has an extremely clean balance sheet with zero leverage – indeed, its assets are almost entirely funded by shareholder’s equity which amounted to 86% of its Total Assets. No significant pension liabilities with pension obligations of $77 mln which are fully funded with plan assets of $84. Conservative structure of plan assets with equities at about 40% and bonds at about 60%.

Executive and Board pay is quite reasonable with the management compensation totaling to about $5 mln. BoD’s aggregate remuneration of $1.1 mln with Mr. Antti Ilmari Aarnio-Wilhuri receiving about $300K as the Chairman, again nothing egregious about that.

Valuation

Trades near its lowest valuation multiples of the past nearly 30 years. About 25% of the market cap is represented by net cash per share.

With the stock trading at about 7% FCF to EV yield and organic growth of about 6% p.a., this translates to a nominal underlying return of 13% nominal.

Please note that I wrote this note when the stock was trading at $40 so the numbers are somewhat different. However, broadly speaking, the same valuations and expected return still hold.

What do the charts say

Having risen nearly 10x since its 2008 lows, the stock has been stuck in an extremely narrow trading range of C$38-48 for the past nine years.

Summary

Winpak is a high quality business that has been able to grow its business and business value at about 6% on an organic basis. At current prices, it sells at less for just about 10x earnings when adjusted for cash and a 30%+ discount to our estimate of the fair value. Given the quality of the business and absence of any corporate governance issues, this discount is bigger than most such businesses sell for. The company has initiated a buyback program for the first time as it recognizes this mispricing.

None of the above constitutes an investment advice. As usual, I leave the readers to do their own due diligence and assess for themselves whether it is a worthy investment for their portfolios.

[1] USDCAD averaged at 1.27 between 1988 to 1997.

[2] Revenues for 1987 of C$ 47 mln translated using using average USDCAD rate of 1.32 for 1987.

_____________

Disclaimer

All information contained herein is provided for informational purposes only and the author expressly disclaims making any express or implied warranties with respect to the fitness of the information contained herein for any particular usage, application or purpose. Prior to making any investment decision you should consult with professional financial, legal and tax advisors to determine the appropriateness of the risks associated with such an investment. No assurance can be given that the objectives of a particular investment will be achieved or that an investor will receive a return of all or part of his or her investment. All investments involve the risk of loss, including the loss of principal. In no event shall the author or any entities managed or associated with be responsible or liable for the correctness of any material used herein or for any damage or lost opportunities resulting from the use of such material. The author, funds managed by the author, or other entities associated with the author may hold investment positions in the securities discussed herein.

Users of this website may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish any information obtained through this website without permission.