Haw Par Corporation

Tiger Balm + UOB & UOL + Lots of Cash: An meaningfully undervalued holding company

BUSINESS:

Haw Par is essentially a combination of one fantastic business which does not require much in the form of reinvestment while growing at a healthy rate and an investment and cash book that has resulted from all that cash generation. The core business is the Tiger balm range of products that has been growing at trend rates of 6-8%. The investment book is comprised of significant cash holdings and strategic investments in two Singapore enterprises: United Overseas Bank (UOB) and UOL Group.

Healthcare accounts for about 80%+ of the core, non-investment operating profits. The company’s Tiger balm range of products is globally distributed. With Singapore being a small market, its home market isn’t a large contributor. The Aw brothers (Boon Haw and Boon Par) founded Tiger Balm in the 1900s in Burma and moved to Singapore in 1926. They tapped their network of newspapers in the region to advertise and promote Tiger Balm. From the 1920s to the 1950s, with Singapore as the base, they succeeded in extending the brand's presence beyond Indochina, into markets like Hong Kong, Thailand, and Malaysia, where Tiger Balm became a household name.

The chart below shows the company’s healthcare segment revenues and its trend over the past twenty years. The trend growth rate of about 6% was itself affected negatively by the large declines of 2020-22 period.

During the pandemic, the segment’s revenues declined by nearly 60%. While the domestic and other countries held up well, Other Asian and ASEAN countries saw very large declines. While in 2023, revenues from ASEAN countries were still below their 2019 highs. Haw Par plans to expand production capacity starting 2025 in Malaysia and launch new product variations in the future to appeal to the new generation of users too.

Underwater park in Pattaya, Thailand is a tourist attraction with an underground long tunnel to observe a wide range of aquatic species and do related activities. A 105-meter-long glass tunnel with over 2500 different sea animals gives tourists the feeling of walking under the sea. It is the only aquarium in Pattaya. Additionally, owns select commercial properties of malls and offices across Malaysia and Singapore. Thai tourism has been in recovery since 2022. This business accounts for about 20% of the core OP.

Strategic Investments. United Overseas Bank and UOL Group investments are classified as strategic stakes. Haw Par receives dividend which forms a majority of other income and nearly 65% of profit before tax of the group.

UOB is a Singaporean bank which also operates across Southeast Asia. It is dominated by Singaporean housing and real estate loans quality of which is driven by the real estate cycle. Currently, asset quality is maintained while historically it faced higher non-performing loans and near 50% equity dilution following real-estate declines of over 30% during 2001-2005 down cycle. Current stock price is near the average of long term Price to book value cycle range.

UOL Group is a Singaporean real estate company which owns and leases commercial properties as well as develops residential properties. It is priced towards 7% FCF yield on EV and quotes at a discount to book value.

Net cash is near SGD 730 million or c.33% of the market cap. It consists of liquid bank deposits and Singapore government treasury bills.

Corporate Governance, Capital Allocation, Leverage

Managed by owners/promoters with reasonable governance indicators with no excessive remuneration or stock dilution and with a consistent progressive dividend payout history. The company has been building up its cash balances over the past few years. In a February 2021 interview, Wee Ee Lim, CEO, stated that it is keeping dry powder to utilize when the right kind of transaction presents itself. While they have been rational in not deploying at elevated valuations, this does present a risk that the company eventually takes a plunge and acquires something while paying too high a price.

A very strong balance sheet with practically no interest-bearing borrowings. As discussed earlier, significant net cash balances that amount to about a third of the current market capitalization.

Valuation

Our valuation band on Haw Par is S$ 10 – 18 and is based on the Historical valuation multiples of the company across a range of fundamental metrics, a Sum-of-the-Parts (SOP) that values the Healthcare business using DCF, and a No Growth and Asset-based Valuation tools combination.

Haw Par’s core business comes across as a high-quality business with high and sticky profitability and extremely high returns on capital. The charts below show estimated profitability and returns on capital of the Healthcare and Underwater Park businesses on a combined basis.

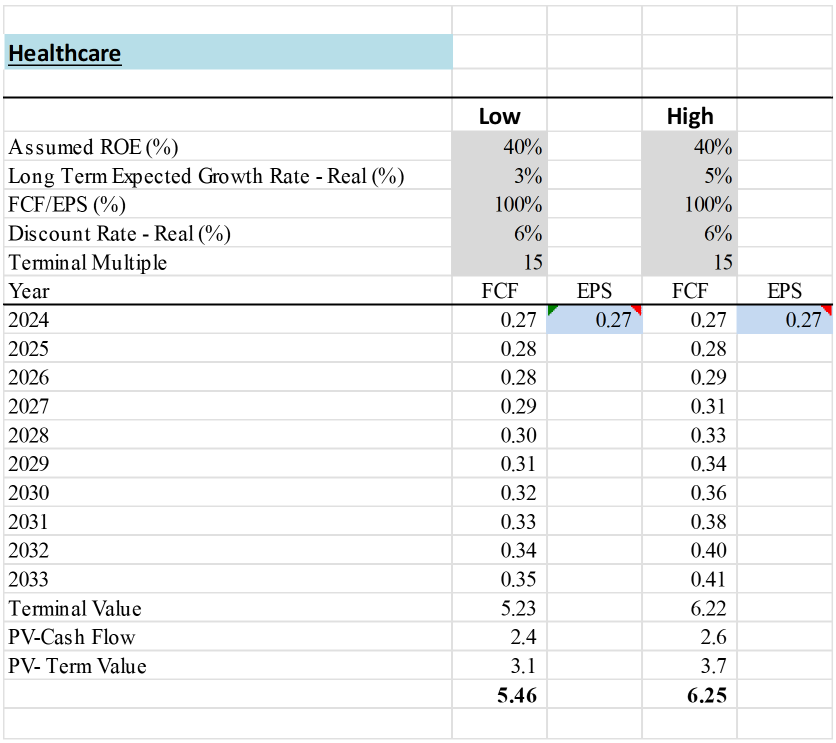

The table below shows a simplified DCF valuation for the Healthcare business. The valuation estimate of the Healthcare business is approximately S$ 6.

The table below shows a simplified sum of the parts valuation for the various businesses and investments of the company. We have applied a 35% MoS to the core business and a 75% MoS to the investments in UOB and UOL with a 10% MoS to cash. The SOP value is S$ 22 per share with S$ 10 level being the price level that affords a reasonable MoS.

Another way to handicap the valuation and the market’s pricing of the company is to value the Healthcare business at No Growth Value and cash and investments with similar discounts as applied in the SOP. The chart below shows the pricing behavior around such a valuation. The stock is currently trading near -1 SD levels and outside of the 2009 low, is the cheapest that it has been.

What do the charts say

The stock is setting up well and is breaking away from a very tight consolidation range that has been in place for nearly a year. Strong support zone near S$ 9.20 >> highs of 2015 & 2016 price actions, 2020 low, and 2022 and 2023 lows.

Shareholding

The founding family owns a 36% stake with UOB owning about 10% of the company as well. First Eagle Overseas Fund owns 10% of the company.

Summary

The company increased its dividend payout from 30 cents to 40 cents which amounts to a dividend yield of 3.8% at CMP. As there are no withholding taxes on dividends in Singapore, this is earned directly in our hands and is a reasonable return to earn while one awaits valuations to return to historical norms.

As always, DYOD. Nothing above amounts to an investment recommendation.

Disclaimer

All information contained herein is provided for informational purposes only and the author expressly disclaims making any express or implied warranties with respect to the fitness of the information contained herein for any particular usage, application or purpose. Prior to making any investment decision you should consult with professional financial, legal and tax advisors to determine the appropriateness of the risks associated with such an investment. No assurance can be given that the objectives of a particular investment will be achieved or that an investor will receive a return of all or part of his or her investment. All investments involve the risk of loss, including the loss of principal. In no event shall the author or any entities managed or associated with be responsible or liable for the correctness of any material used herein or for any damage or lost opportunities resulting from the use of such material. The author, funds managed by the author, or other entities associated with the author may hold investment positions in the securities discussed herein.

Users of this website may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish any information obtained through this website without permission.